MFT Gateway is a hosted Software as a Service (SaaS) solution that enables file exchange over the AS2 or SFTP protocol, without the need to install or maintain.

- Blog

- EDI in Mergers & Acquisitions for Regulated Industries

EDI

EDI in Mergers & Acquisitions for Regulated Industries

Learn how EDI supports compliance, data integrity, and seamless B2B integration during M&A in regulated industries like healthcare and finance.

Sampavi Sriparan

Published: 07 Aug 2025

Mergers and acquisitions (M&A) may be a complicated process to any business, however, when they take place in regulated industries like pharmaceuticals, healthcare, finance or energy, the complexity increases exponentially. These areas are regulated by strict regulatory demands in relation to the treatment of data, patient or client confidentiality, accuracy of reporting, and interoperability of systems. Electronic Data Interchange (EDI) is critical to continuity of operations, compliance and smooth data integration between merging organizations. EDI makes it possible to exchange business-critical documents such as purchase orders, invoices, shipment notices, and regulatory filings, which are structured and processed between systems without any human involvement.

Why Regulated Industries Need Special Attention During M&A

Regulated industry sectors are bound by strict legal and operational requirements, and even minor violations can have a profound impact on the finances, legal status and reputation. When mergers or acquisitions occur in these industries, remaining compliant throughout the transition is as hard as integrating the businesses.

1. Data Privacy and Security Requirements

Laws, such as HIPAA, GDPR, and GLBA, have strict regulations on how sensitive information, such as patient health records, financial transactions, and personal identifiers, should be handled, transmitted, and stored. Any integration effort done as part of M&A should ensure system migrations do not lead to misrouting, unauthorized access, or leakage of information. Penalties can be very high to break privacy protection and stakeholder trust can be influenced.

2. Auditability and Traceability

These industries must maintain detailed audit trails to demonstrate compliance with regulation. As an example, a healthcare claim or a batch record of a pharmaceutical product must be traceable at every step of the process, between creation and final submission. This audit trail should be retained in the case of system migrations or consolidations as part of an M&A. To ensure auditability of the transition, Electronic Data Interchange (EDI) systems, which capture every transaction and acknowledgement, are required e.g. 997 or MDN.

3. Compliance with Industry Standards

Electronic records, signatures, and financial reporting have strict control guidelines as outlined in such standards as FDA 21 CFR Part 11, SOX (Sarbanes-Oxley), and PCI-DSS. To remain compliant, all the changes made to the system infrastructure by the M&A process, including the integration of archiving systems, encryption/signature certificates, or EDI platforms, need to be verified and documented carefully.

Role of EDI in the M&A Lifecycle

EDI maintains operational continuity, legal compliance, and minimizes disruptions across partner ecosystems. The following details the role of EDI across the five major stages in the M&A lifecycle:

1. Pre-Merger Assessment

It is essential to conduct a comprehensive audit of both entities’ EDI capabilities before integration efforts begin and to ensure that integration planning can begin on proper footing.

Key Activities:

-

Transaction Inventory

List all the messages being used (X12 850 Purchase Orders, 810 Invoices, 856 ASNs, EDIFACT INVOIC, etc.) and poll each of the trading partners on their use. -

Mapping and Format Comparison

Compare mapping variations among the department or business units. Seek duplicated groups, custom mapping and industry segments. -

Compliance Review

Review how each entity manages compliance—encryption, signatures, archiving, audit trail, etc.

2. Data Migration and Integration

Once the acquisition is complete, integration starts – usually very quickly. EDI provides you with a systematic and safe way to migrate and integrate without interrupting business as usual.

Key Activities:

- Move trading partner settings, mapping templates, and routing rules of the acquired company and the acquiring company to the partner and mapping migration.

- Data Normalization: Any syntax differences should be normalized and the format should be standardized to prevent accidental interpretation of transactions between systems.

- Certificate and Directory Merge: Combine certificate stores (to be used with AS2 or SFTP) and partner directories and preserve verification trails.

- Continuous Document Exchange: It should be ensured that cutovers should not cut off all transactions like orders, invoices, or even shipping.

3. Regulatory Compliance

In such sectors as healthcare, finance, and pharmaceuticals, compliance is not a matter of discussion. The EDI tools assist organizations to be trusting and transparent when they have to undergo transformative change.

Key Activities:

- Archiving of Historical Data: To keep on preserving the history of inbound and outbound EDI messages in case of audits.

- Authenticity and Integrity are Musts: Ensure documents have a tamper-proof signature and timestamp.

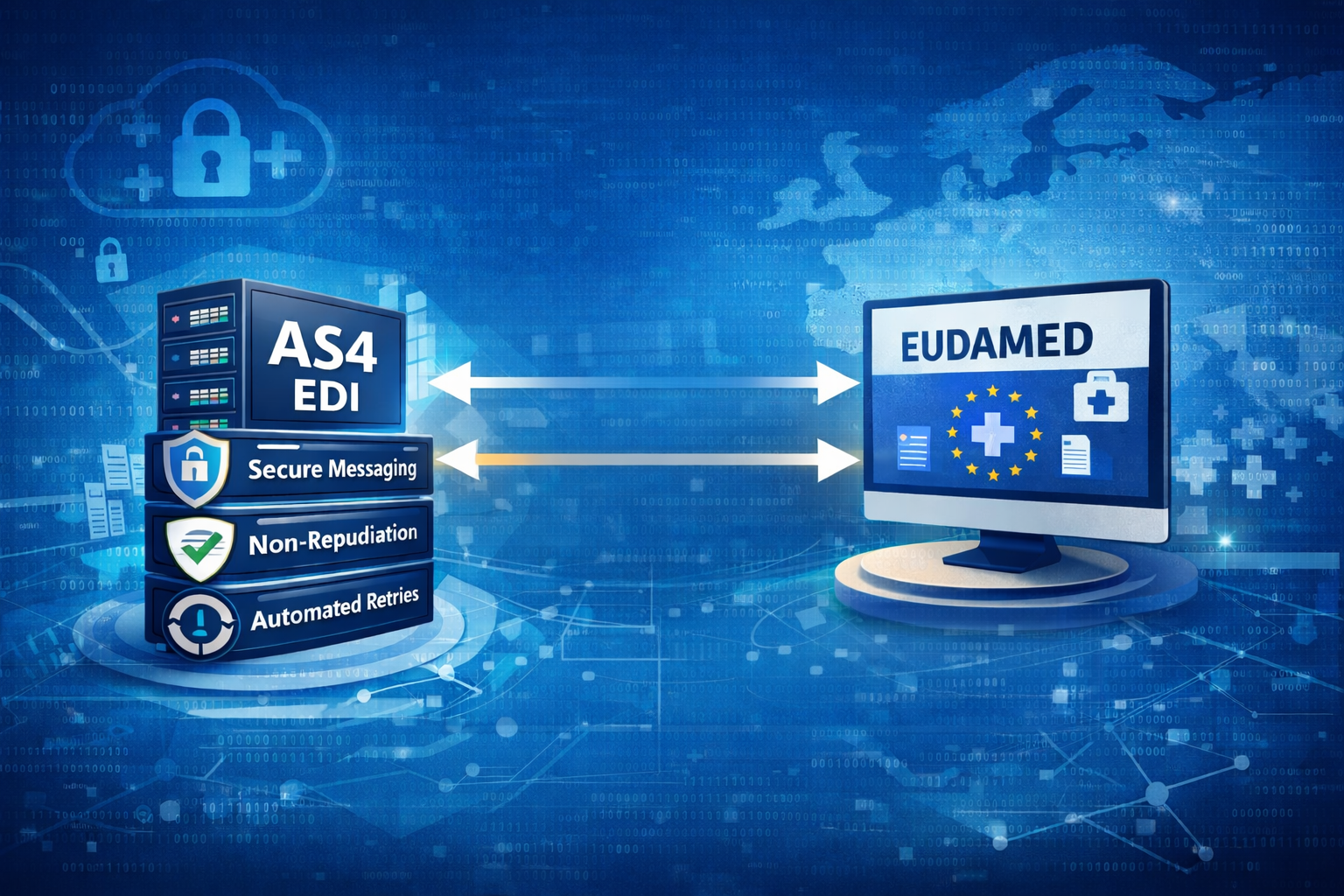

- Guaranteeing Non-Repudiation: Deliver a piece of evidence using MDNs (Message Disposition Notifications) and digital signatures that confirm delivery and acceptance. This can support non-repudiation for legal or regulatory obligations.

4. Partner Communication and Re-Onboarding

After EDI environments are merged, a partner communication will require modification to correspond to the new structure of the merged entity. The given transition will be aimed at further relationship development and stakeholder trust within the partner network.

Key Activities:

- IDs and endpoint validation: Partner messages need to revise or confirm AS2 identifiers, endpoint URLs and authentication identifications.

- ISA/GS IDs: Interchange and Group IDs changes should be reported to all partners to prevent rejections or wrong routing.

- Testing and certification: Possible rounds of testing should be done on high priority trading partners to check message transmissions, validations of schema, and acknowledgements.

5. Risk Mitigation

M&A transitions come with their risk failure of occurrence whenever there is an inclusion of business-continuity systems like EDI. The problem of mapping issues, failure of communication, and/or system outages may be extensive.

Key Activities:

- Error Detection and Correction: Apply validation rules and schema enforcement and /or pre-processing checks, to help detect errors early.

- Real-Time Tracking and Alerts: Track the flow of the documents in real-time using dashboards and alert systems, and develop a rapid response mechanism that will respond to failures whenever they arise.

- Fallback and Recovery Mechanisms: Put in place and ensure that retry logic, queue and MDN tracking mechanisms are in place and working in the event of data loss and/or recovery.

Conclusion

In the high-stakes regulated industries M&A process, success often hinges on your ability to retain data integrity, follow compliance requirements, and keep business moving. EDI is literally the backbone for your digital presence, simplifying data exchanges and communication between merging companies.

If you strategize the merger and EDI integration as early as possible, and create a robust strategy that takes advantage of the features available in secured and scalable integrations with AS2 Gateways and MFT solutions, a once labyrinthine M&A process can become an orchestrated transformation.

The EDI Generator has the ability to track file documentation using an archive feature. When you combine an EDI Generator with an MFTG (Managed File Transfer Gateway) and an AS2G (AS2 Gateway) the entire process is not only automated but also reliable. Considering the ability to maintain business continuity and regulatory compliance during a merger, it is also robust from a security perspective.

Talk to an EDI Expert

Join hundreds of organizations already taking full control of their B2B AS2 communications with our trusted solutions. Contact us today to tailor a solution that fits your specific AS2 EDI needs.

Related Articles

View All BlogsExplore our product stack

Try before you buy with a 30-day Free Trial

No commitment, all value. Try the AS2 Solution Risk-Free and discover how our solutions can transform your business workflows. No credit card required.

Explore Your Possibilities

Elevate AS2 Communications with our EDI and AS2 Solutions

See how our AS2 and EDI solutions can simplify your integrations, boost efficiency, and keep you compliant—request a personalized demo today.