MFT Gateway is a hosted Software as a Service (SaaS) solution that enables file exchange over the AS2 or SFTP protocol, without the need to install or maintain.

- Blog

- How EDI Payments Improve B2B Speed, Efficiency & Security

EDI

How EDI Payments Improve B2B Speed, Efficiency & Security

Learn how EDI payments enhance speed, accuracy, cost savings, and security in B2B transactions across industries.

Indunil Rajapakse

Published: 06 May 2025

Table of Contents

Electronic Data Interchange (EDI) payments are a digital method of communicating payment-related information between businesses that converts manual transactions into automated, digital transactions. It simplifies operations by automating data flows between systems, increasing efficiency and accuracy. EDI payments are widely used in various industries, including retail and manufacturing, to streamline supplier coordination and inventory management, significantly improving the speed and efficiency of faster B2B transactions. This paperless method saves time and money while reducing errors and improving cash flow management. By linking EDI systems and transitioning from manual payment document transmission to EDI payments, businesses can gain a competitive advantage in the marketplace, as it enhances efficiency, reduces errors, and boosts productivity.

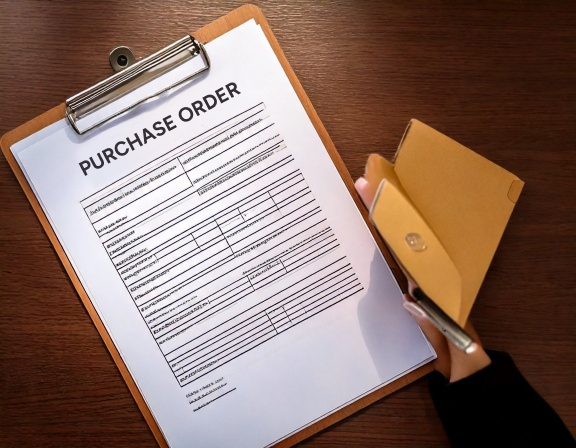

Manual payment processes include creating a purchase order, confirming it, and receiving an invoice, all of which require significant human involvement. The buyer’s accounts payable employees manually input the invoice information, compare it to the original order, make the payment, and file any associated documents for record-keeping. This lengthy, error-prone, and expensive process increases the likelihood of delays and mistakes.

Let’s take a look at how the EDI payment procedure generally works:

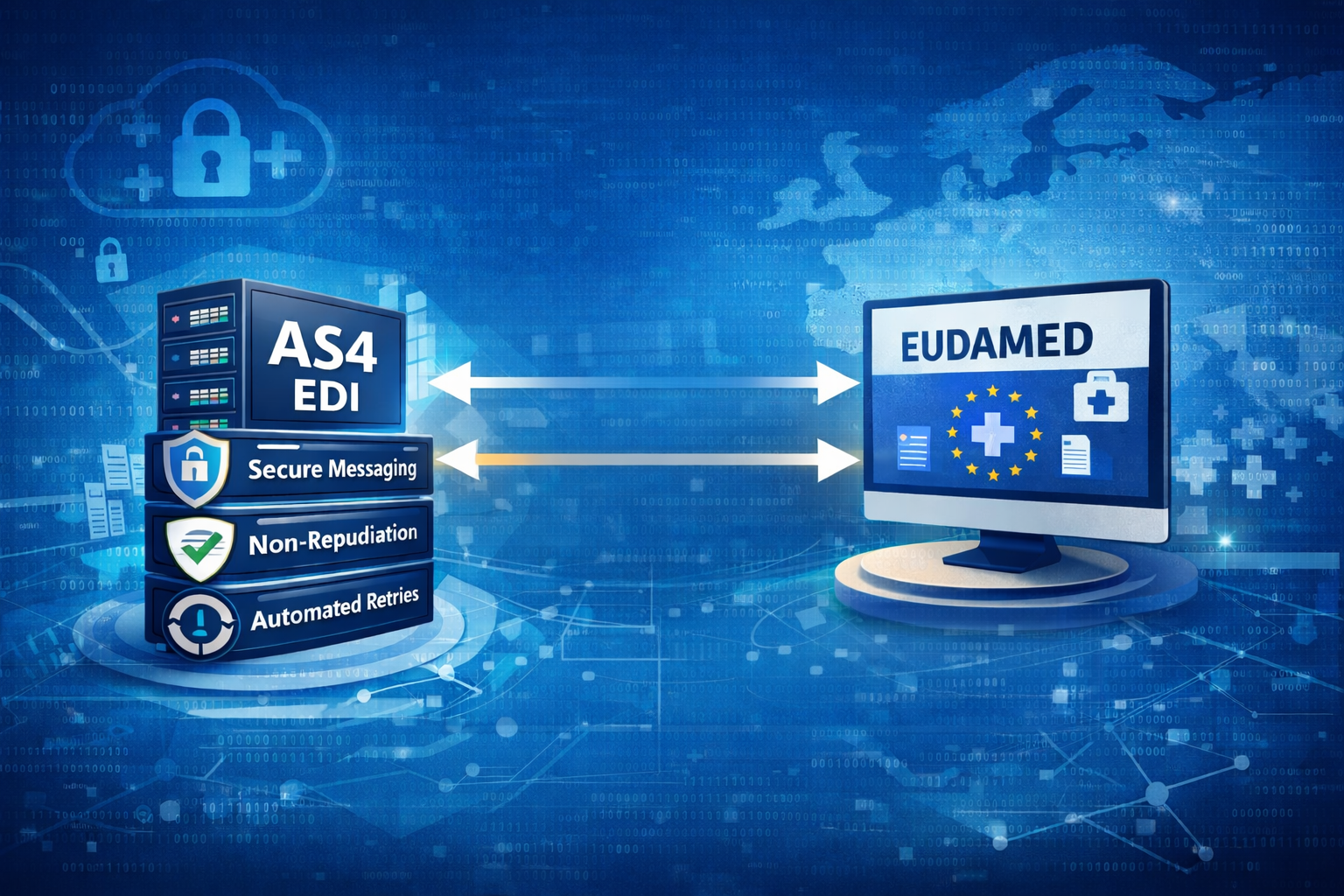

Initiation: The buyer creates a purchase order (PO) electronically, which is then sent to the supplier using EDI standards, such as ANSI X12 or UN/EDIFACT. The PO includes information such as item quantities, pricing, shipping details, payment amount, payee details, and payment due date. This should be delivered to the seller’s system via secure communication protocols, such as AS2.

Order Acknowledgment: The supplier confirms receipt and acceptance of the order that contains information such as confirmed quantities, shipping dates, and any revisions to the original order. This acknowledgment guarantees that both parties are in agreement before the fulfillment process begins.

Invoice Generation: After the goods or services are delivered, the vendor generates an invoice that is transmitted directly to the buyer’s system. The invoice is automatically matched to the original order and delivery confirmation, which helps speed up the approval and payment processes. This invoice details the agreed-upon amounts, taxes, shipping costs , and payment arrangements.

Payment Transfer: Once the buyer approves the payment, payment information is sent to the vendor based on the chosen payment method. The agreed-upon payment is processed by the bank or financial institution. The payment remittance advice is used to inform both the buyer and supplier when funds have been transferred.

Completion of EDI payment: Both parties can reconcile their accounts electronically, and both the buyer and supplier receive confirmation of the completed payment once the transaction is completed. EDI ensures that payment details match the original purchase order, invoice, and remittance information, reducing errors, increasing transparency, and speeding up the reconciliation process. It also enables real-time tracking and visibility into all stages of the payment process helping to increase the overall efficiency of B2B transactions.

Benefits of EDI Payments

-

Efficiency and Cost Saving

EDI payments eliminate the need for manual entry, paper-based operations, and time-consuming administrative procedures. It also reduces expenses associated with printing, postage, storage, and labour. EDI helps minimize processing errors and lower settlement costs, while providing real-time visibility into payment statuses. By speeding up transaction cycles and boosting operational productivity, business can respond quickly to challenges and make more profitable decisions.

-

Improved Security

To protect sensitive financial data during transmission, EDI systems use encryption, secure communication protocols, and authentication. This reduces the likelihood of data breaches, fraud, and unauthorized access, compared to traditional, paper-based payment systems. EDI also provides comprehensive audit trails and transaction logs, allowing firms to track activity and verify compliance with industry requirements. With its high level of security, EDI is a reliable solution for managing B2B payments.

-

Increased Accuracy

EDI payment methods automate the transfer of financial data between business applications, reducing human error and maintaining consistency across systems. This leads to faster invoice matching and reconciliation, fewer payment delays, and greater financial stability. EDI also accelerates transactions, allowing for quicker approvals, processing, and reconciliation times. It can be integrated with existing financial systems to enhance cash flow management, supplier relationships, and operational efficiency.

EDI Generator - EDI for Retail/Logistics

EDI Generator is a cloud-based EDI application that enables businesses to streamline their supply chain operations, increase vendor engagement, get real-time visibility, and optimize transaction processes while eliminating errors.

EDI Generator provides affordable SaaS subscriptions for businesses, with no hidden costs. Users can start with a 30-day free trial and choose from monthly, quarterly, or annual subscription plans and cancel at any time. The Aayu Technologies support team is available to assist with any concerns encountered throughout the EDI or AS2 communication setup process. Integrating EDI into your business helps eliminate errors, enhancing collaborations, increasing efficiency, and offering visibility for successful growth. Choosing the right EDI provider and strategy is a game changer and helps businesses to achieve long-term success.

Conclusion

The EDI payment process is a faster, more accurate, and cost-effective alternative to old manual payment processes. It removes the need for paper, printing, and manual data entry. EDI payments allow organizations to optimize their payment processes by reducing processing time, minimizing errors, and improving transaction visibility. This B2B payment automation lowers costs, boosts operating efficiency, and improves accuracy. Businesses that utilize EDI payment systems can streamline their payment procedures and increase overall efficiency.

Talk to an EDI Expert

Join hundreds of organizations already taking full control of their B2B AS2 communications with our trusted solutions. Contact us today to tailor a solution that fits your specific AS2 EDI needs.

Related Articles

View All BlogsExplore our product stack

Try before you buy with a 30-day Free Trial

No commitment, all value. Try the AS2 Solution Risk-Free and discover how our solutions can transform your business workflows. No credit card required.

Explore Your Possibilities

Elevate AS2 Communications with our EDI and AS2 Solutions

See how our AS2 and EDI solutions can simplify your integrations, boost efficiency, and keep you compliant—request a personalized demo today.